The Penn Office of Investments is responsible for investing the University’s endowment and pension assets.

About the Endowment

Penn’s endowment provides critical support for the University’s goal of becoming the most inclusive, innovative, and impactful university in the world. Totaling $24.8 billion as of June 30, 2025, the endowment is comprised of over 8,900 individual endowment funds benefiting the University’s schools, centers, and the University of Pennsylvania Health System.

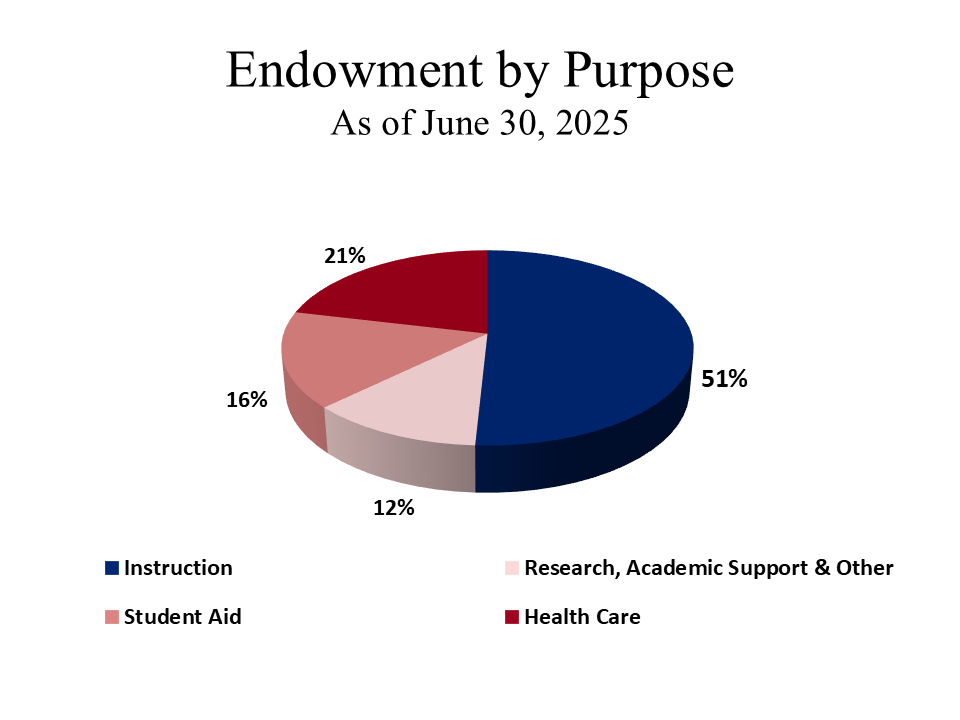

Every year, the endowment distributes money to support a wide range of purposes across the institution, with most of the funds dedicated to instructional use and student financial aid. Penn’s annual target payout rate is typically 5% of each endowment fund. The exact payout in any given year is determined by Penn’s spending rule, which smooths the impact of short-term changes in portfolio value on the amount of the spending distribution. Spending distributions have grown by an annualized 13% over the last decade and now support 19% of the University's academic budget, up from 12% ten years ago. During fiscal 2025, distributions from the endowment provided nearly $1.1 billion in budgetary support to the University. This is up nearly $61 million from the previous year. Over the past decade, the endowment has distributed nearly $7.8 billion to support the University.

Most of Penn’s endowment is invested in the Associated Investments Fund (AIF), a pooled investment vehicle in which the many individual endowments and trusts hold units. The Office of Investments—consisting of 36 investment, operations, and administrative professionals—manages the AIF. A distinguished Investment Board, consisting of Penn alumni and University leadership, oversees the activities of the Office.

Endowment Performance

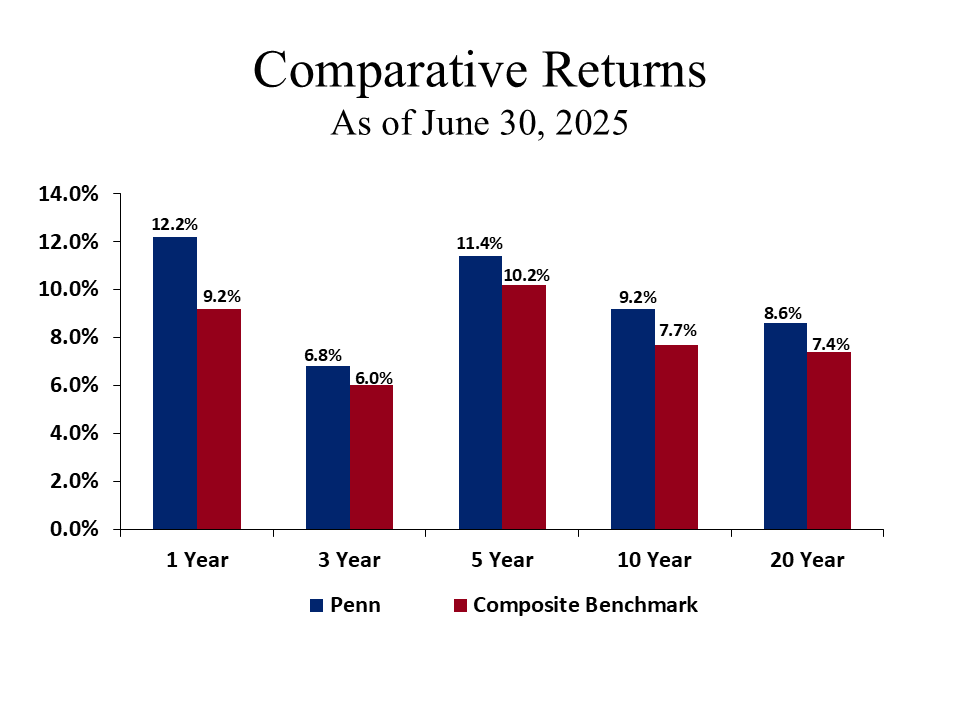

Penn’s endowment produced an investment return of 12.2% for the year ending June 30, 2025. Total endowment assets increased by $2.5 billion during the year, reaching $24.8 billion as of June 30. Of this amount, approximately $19.5 billion represents assets that support the University, while $5.3 billion represents assets that support the University of Pennsylvania Health System. The endowment’s growth reflects the impact of investment returns, spending distributions, new gifts, and internal transfers.

Over the past five years, the endowment has returned an annualized 11.4%. The endowment returned 9.2% and 8.6% per annum over the past ten and twenty years, respectively. Penn’s performance has consistently outpaced a composite benchmark for these periods. Importantly, Penn’s long-term performance has enabled the endowment to reach its goal of maintaining purchasing power after spending distributions.